Less than perfect credit can come to haunt you. A track record of late money or outstanding expenses causes it to be tough to pick a property, book a condo, otherwise get a car loan. In reality, bad credit could even imply large costs: statement company was legally permitted to charge you alot more in order to have less than perfect credit.

It doesn’t must be like that, in the event. With some homework and effort, you might nip your own less than perfect credit regarding the bud. Step one? Addressing the fresh new bad items on the declaration.

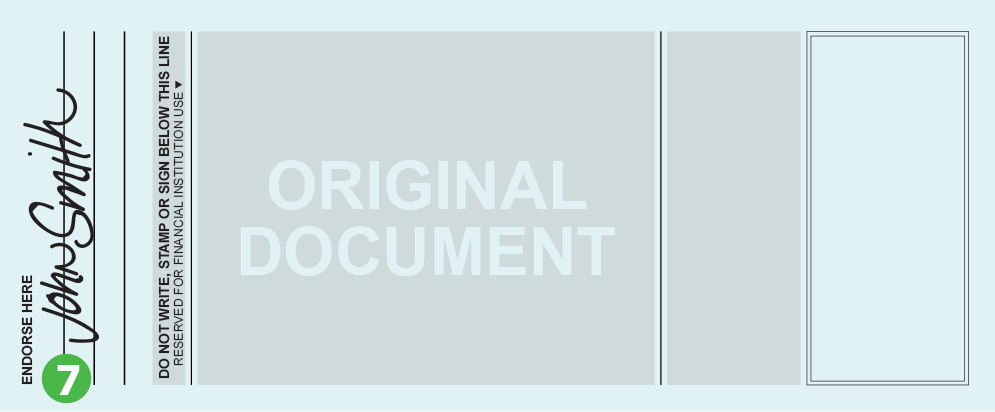

Step 1: Review Your credit report

Prior to some thing, we wish to obtain a copy of your credit report. Luckily, it’s free immediately after a year, and it’s as easy as navigating in order to AnnualCreditReport and you can requesting it. You may be greeting you to totally free content of your credit history on a yearly basis off all the about three major credit agencies: TransUnion, Equifax, and you may Experian. It is vital to be mindful of all the three because often you will find discrepancies between them. As an instance, your own Experian credit history might have a blunder when you are your TransUnion and you will Equifax records are really well accurate.

When you are getting your own backup, you can find a complete area intent on every bad things. These represent the membership pulling your borrowing from the bank off: the credit debt or a vintage utility bill you do not paid back, for example. Such negative goods are new profile we should augment.

According to Experian, here’s how enough time six prominent negative factors remain on the report if you aren’t in a position to get them:

- Collection levels: 7 ages following the basic delinquency

- Later repayments: 7 ages in the basic later fee, whether or not you swept up in addition to account was latest or finalized

- Chapter thirteen bankruptcy proceeding: eight many years

- Chapter 7 personal bankruptcy: ten years

- Paid income tax liens: eight ages

- Delinquent tax liens: a decade

Pole Griffin, Movie director regarding Societal Studies from the Experian, teaches you why these bad items have less off a bearing more time:

It is wise to pay your financial situation, but if you might be unable to pay the bills, you should know the length of time you have got up until the negative items drop off the report. It is really not most readily useful, however you may be able to live with them on your own declaration for the present loans in Marble time, given you don’t need to make use of your borrowing for the reason that go out body type.

2: Find Errors and Conflict Them

Once you’ve analyzed the possibly negative situations, earliest guarantee that there are no problems. You’ll find a handful of different varieties of errors you will want to pick in your report:

- Accounts that don’t belong to you

- Negative products which provides expired but haven’t yet fell off the report

- Personal data problems

- A repaid membership that is nevertheless detailed once the outstanding

Should you look for a blunder, you can easily first should alert new creditor. This new Federal Change Payment makes the procedure simple with this specific attempt letter. Fill out the newest blanks, next post the page towards collector, and additionally one documents supporting your own conflict. They might be forced to browse the things concerned, constantly in this 30 days. If they agree that discover an error, its work in order to notify all around three credit reporting agencies so they can develop your declaration. You can also consult having her or him posting notifications to virtually any agency that’s pulled your statement within the last 6 months.

When they don’t think there’s a blunder, you could potentially at the very least require a notification off argument to be included toward future profile. It is possible to argument to your bureaus yourself, and additionally they allow easier than you think. Experian, for example, lets you really conflict those people mistakes due to their online means.